Colin Read • October 22, 2022

A Better Mousetrap - October 23, 2022

A Better Mousetrap - Everybody's Business - October 23, 2022

This week the New York District Federal Reserve released an interesting report. It documented and quantified something we have all noticed.

Our work week has changed dramatically over the past couple of centuries. Before the Industrial Revolution, we worked as much as was needed to subsist living off the land. Before settlements, hunters and gatherers realized no value in working more than necessary to provide for food for a few days, since long term cold storage was impossible and large caches of food made tracking nomadic animals difficult. Even with settlements, most people still worked on the land, and hence there is little reason to harvest more than one could eat.

It was not until the Industrial Revolution that people began to work incredibly long days. In manufacturing, more work hours meant more manufactured products to satiate the wants of more people who earned more money because they worked more. This unvirtuous cycle also drove down the price of goods, which then required managers to work their employees even more to preserve profits.

These long days under poor working conditions prevailed almost to the brink. Workplace safety standards began to emerge in the late 1800s and early 1900s, especially in the protection of child labor. It was not until Henry Ford realized that an eight hour shift was optimal for worker productivity in his factories open for twenty four hour days. Staffing needs rose, but so did productivity per hour worked, and wage paid.

The forty hour work week was standardized in the U.S. as a mechanism to spread out the available work in the Great Depression to combat unemployment. The great Depression-era economist John Maynard Keynes predicted that, with increased productivity, the work week could fall to 15 hours by 2030.

Since that innovation, people have pondered why the standard ought to be 40 hours per week, beyond the mathematical convenience it has for three shifts per day driven by eight hour shifts. Especially now that manufacturing has shrunk to 10% of Gross Domestic Product, people are now reconsidering not only the length of the work week but where it can be performed. The realities of COVID-19 and the need to socially distance has brought such discussions to the forefront.

This week, in their

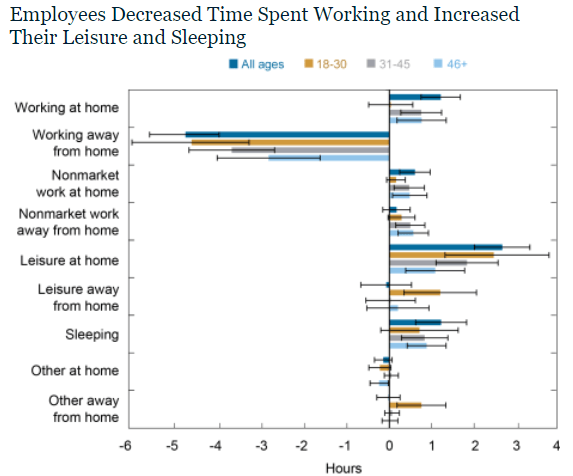

Liberty Street Economics series, the New York Fed revealed that 15% of the traditional full time workforce now works at home, and 30% of work is now performed in a hybrid home/office arrangement. Every day, Americans save 60 million hours in commuting.

People have used this savings in time to socialize more, exercise more, and relax more, feed the family in more food preparation, fix the house, and do more home based child care. People are even getting more sleep. All these aspects are raising important quality of life measures.

Americans are also saving money. The average wage rate in the U.S. is a bit over $30 per hour. $1.8 billion is saved daily in reduced commuting, at the imputed value of our time based on our average salary. The IRS imputes driving costs (fuel, ownership, repairs, etc.) at $0.60 per mile, which, if the average commute is at a speed of about 30 miles per hour, another $18 per hour is saved. If we sum these values over about 250 work days per year, these savings account for almost three quarters of a trillion dollars of avoided costs per year. Meanwhile, the reduced stress we incur by avoiding rush hour commuting is priceless.

The size of these savings is huge. They represent about half of the total taxes we pay to the Federal Government. Since commuting costs are typically not tax deductible, these savings also amount to tax free income, both directly in reduced commuting costs, and indirectly in increased time available to us for quality of life activities.

Flexible work does not work for all. Some people prefer to work in a more structured environment, but still appreciate the agency in their ability to make that decision themselves. Some jobs will never be amenable to work-from-home. I am glad my local firefighters don’t work from home. Most manufacturing requires collocation with expensive machinery and available stocks of supplies. But, much of the economy is amenable to work-from-home, especially as people have come to expect that many routine functions, from banking to the DMV, even education and routine medical visits, can and should be done over the Internet.

The group that seems to have the biggest problem with work-from-home are bosses who find it difficult to be good managers. Some managers may prefer employees that are sufficiently unstructured and ignored at work to have abundant time to surf the Internet and update their social media. Poor managers perhaps believe their workers will be even more poorly motivated and managed if allowed to work from home. That is not a problem with a new work model, though. It is more of a problem with poor managers who are unable to adapt to better supervisory techniques and are unwilling to leverage technology to encourage productivity. While poor communications of expectations and ineffective feedback are the hallmarks of poor management, simply having people work out of a cubicle is not a solution.

After a few years that have forced us to reevaluate work and productivity, there is probably no going back. I’m quite sure Keynes’ 15 hour work week by 2030 will not come to fruition. But, the train has left the station. The McKinsey consulting group estimates that almost half of all work will be automated in about 30 years, certainly in most of our lifetimes. It is time for us to see the trends, embrace the new reality, and get on with our business - in a new way that far better integrates our work and personal life. The biggest challenge may be to ensure the efficiencies of these innovations remain with the working class rather than usurped by the 1%ers.